In nowadays’s rapidly-paced and unpredictable company ecosystem—Specially through the numerous marketplaces of the center East and Africa—having access to accurate, trustworthy, and timely details about the companies you do enterprise with is not optional. Firm Credit score Studies are becoming An important tool for businesses looking to handle credit hazard correctly, prevent high-priced defaults, and make knowledgeable conclusions.

1. Make Assured Credit history Selections with Dependable Data

A comprehensive company credit rating report offers an in-depth overview of a company’s monetary security, operational background, payment habits, and lawful standing. With this particular information and facts at your fingertips, your crew can:

Evaluate creditworthiness before extending phrases or featuring funding

Recognize purple flags like late payments, lawful disputes, or deteriorating financials

Mitigate risk by customizing credit score limitations and phrases for every customer or provider

This is very important in the MEA region, in which publicly readily available financial information is usually restricted or inconsistent.

2. Improve Threat Management Throughout Borders

Undertaking business enterprise throughout many nations around the world in the Middle East and Africa means coping with various regulatory systems, amounts of transparency, and economic circumstances. Company credit history stories provide you with a standardized risk profile, encouraging you to:

Compare providers across marketplaces employing regular credit scoring

Have an understanding of community context, including modifications in enterprise laws or region risk

Make a regional credit history policy determined by serious info instead of assumptions

3. Defend Your company from Payment Defaults

Among the list of top factors firms go through hard cash flow issues is due to delayed or unpaid Company Credit Report invoices. Business credit reports assist decrease this danger by providing:

Payment background insights, showing how instantly a business pays its suppliers

Credit rating developments, indicating bettering or worsening behavior over time

Alerts and updates, so you’re knowledgeable of any considerable modifications that may have an affect on payment dependability

Being proactive, rather then reactive, will help you steer clear of avoidable losses and sustain a healthy stability sheet.

four. Streamline Onboarding and Homework

When bringing on new clientele, associates, or sellers, an organization credit history report simplifies and accelerates your due diligence approach. With only one doc, you can assessment:

Business enterprise registration and possession structure

Crucial fiscal ratios and yearly turnover

Individual bankruptcy documents, lawful judgments, and regulatory flags

This hastens choice-generating when guaranteeing compliance with inside possibility procedures and external rules for example anti-income laundering (AML) criteria.

5. Reinforce Negotiating Electrical power and Strategic Preparing

A transparent comprehension of your counterpart’s fiscal overall health provides you with leverage in negotiations. You'll be able to:

Adjust payment conditions, for example requiring advance payment or shorter credit cycles

System for contingencies, by figuring out suppliers or customers who may well present possibility

Prioritize partnerships with firms which are fiscally secure and minimal risk

While in the MEA location, exactly where economic shifts can manifest swiftly, this foresight is very important to defending your organization interests.

6. Help Portfolio Monitoring and Reporting

When you’re managing a big portfolio of purchasers, sellers, or borrowers, keeping track of each entity’s credit health can be quite a key problem. Firm credit score studies allow you to:

Keep an eye on improvements after some time with periodic updates

Section your portfolio by threat level, industry, or geography

Generate actionable insights for inside reporting or board-degree conversations

This enables for far better strategic preparing, compliance reporting, and overall credit rating threat governance.

Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Heather Locklear Then & Now!

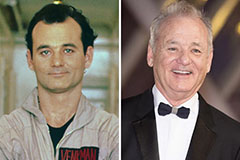

Heather Locklear Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!